The SP500 Index Update: October 21, 2024

This is an update on the SP500 Index as of October 21, 2024.

Since my last message on September 30, there haven’t been any major changes in the long-term view of the market for the 20 and 40 weeks cycles. Let’s break down what’s happening and what we can expect in simpler terms.

Overview of Market Cycles

Long-Term Cycles

The SP500 Index is still looking strong, which means it is bullish.

The best way to label the SP500 index cycles is still based on the low point we observed on August 5. We expect that during the upcoming 20-week correction, the SP500 index might dip below its cycle line, which is represented by the green line on the chart.

When the SP500 index crosses below this line, it can signal a sharp decline, depending on where this happens. The next expected low point for the SP500 index is around December 14, when the cycle lines will be near 5,720.

If the peak of the SP500 index occurs around mid-November, we might see cycle lines ranging from 5,600 to 5,500. The timing of the peak—whether it happens earlier or later—will be very important for the future direction of the market.

Short-Term Cycle: 20 Days

Now, let’s look at the shorter 20-day cycle.

After the last low point on September 23, the SP500 index crossed slightly below its cycle line. This crossing happened at 5,700 on October 2, with a target for the market to drop to 5,633. The low point on October 7 was at 5,686, which was very close to our target—only 53 points away. Since this low was within 1% of our target, we consider it a success.

On October 9, the SP500 index crossed back above its cycle line at 5,752.63, setting a new target of 5,818.41. Just two days later, on October 11, the SP500 index reached that target, resulting in a profit of 66 points, or about 1.14%. If trading futures market, this could mean a profit of $16,500, or $3,300 for micro E-minis.

The next peak in this 20-day cycle is expected around October 19, with a low point around October 25. At that time, the cycle lines will be approximately at 5,830.

For more details on the 20 days cycle, see the 80 days cycle roadmap.

Mid-Term Cycle: 40 Days

Next, we look at the 40-day cycle.

On October 8, the SP500 index completed its second 40-day cycle since the significant low on August 5. Normally, we would expect the market to dip below its cycle line at this stage, but because of the current bullish trend, the SP500 index found support instead.

This suggests that there is still strong positive momentum in the American stock market.

The peak for this 40-day cycle is expected around October 25, with a low expected on November 11. During this upcoming low, I anticipate that the SP500 index will cross below its cycle line and set a new downside target.

After confirming the last low of the 40-day cycle, I drew a trend line (the red line) that will help us identify the next potential peaks for the 40 and 80-day cycles. If the SP500 index crosses below this trend line, it may confirm the next peak for the 20-week cycle.

The target of 5,822, which was triggered in mid-September when the SP500 index crossed above its cycle line at 5,613, was reached on October 11, with the market hitting a high of 5,822.13. Since we are starting a new 40-day cycle, the trend for this week is upward, and the success rate is around 88%.

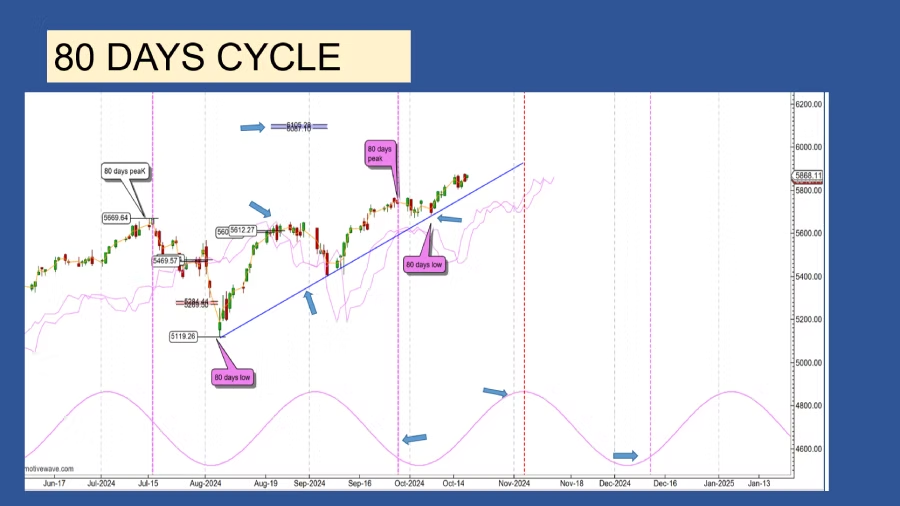

Long-Term Cycle: 80 Days

Moving on to the 80-day cycle, we initially expected the last low to form on October 15. However, due to the bullishness in the market, it actually hit its low a week earlier, on October 8.

We anticipated that the SP500 index would find support on its cycle line. Still, the low came in about 80 points above this line, indicating strong market momentum.

The targets of 6,105.28 and 6,087 set in August are still valid. If the SP500 index crosses below its cycle line before reaching these targets, we may see a sharp correction leading up to the 20-week cycle.

The next expected low for the 80-day cycle is on December 14. The peak of the precedent 80-day cycle formed on September 26 at 5,767.37, and because the next low will mark the end of the 20-week cycle, we expect the next peak to form earlier in the cycle.

From the low on August 5 to the recent 80-day low on October 7, I drew a trend line to track the cycles (the blue line on the chart). If the SP500 index crosses below this line, it will help us identify both the next 80-day peak and the crucial 20-week peak.

Expect the 80-day cycle peak to occur around November 11. The cycle trend is currently upward, with a high success rate of 100%.

Here the roadmap for the 80 days cycle

The current 80-day cycle began on October 8, 2023. On October 9, the market surged above its cycle line, indicating a target for the 20-day peak.

Following this peak, the S&P 500 index is expected to undergo a correction and should find solid support along its cycle line. After this correction, the market is poised to resume its upward trajectory, aiming to establish the 40-day cycle peak.

Once this peak is reached, the market will likely dip below its cycle line, setting a downside target for the 40-day cycle, anticipated around November 11.

After this, the S&P 500 should initiate a new rally toward the next 80-day cycle peak, crossing above its cycle line and establishing a new upside target.

As the 80-day cycle completes, the S&P 500 index will again dip below its cycle line, indicating a downside target for the subsequent 80-day low. During this period, we expect the market to form an initial low in the last week of November, followed by a rally toward the cycle line, which will serve as resistance. Ultimately, the market is projected to reach the 80-day low around December 14.

Monthly Time Frame

Looking at the monthly time frame, the last SP500 index 18-month cycle was in October 2023.

We expect the next one during the first quarter of 2025. A key question is how significant the correction will be during the next 18-month cycle.

Typically, the SP500 index should cross below its cycle line, providing a downside target.

Let’s consider different scenarios for this 18-month cycle. Given the current bullish trend, it is likely that the SP500 index will find support on its cycle line.

In March and April, we expect the 18-month cycle to be between 5,400 and 5,500.

This scenario is plausible as we are already in the 12th month of this cycle, suggesting the next peak will occur late in the cycle, which is usually favorable for the market with only moderate corrections.

However, if we see a sharp decline during the next correction, this indicates that larger cycles, like the 3.5-year or 9-year cycles, could pose more downward pressure.

The bearish scenario suggests that the peak might form this month or next month, leading to a significant decline.

For the SP500 index to cross below its cycle line, it would need to drop to around 5,000.

Here are the cycle lines for the next few months:

– October: 4,800

– November: 4,980

– December: 5,160

– January 2025: 5,108

– February: 5,180

– March: 5,378

Depending on when and where the SP500 index crosses its cycle line, we can predict where the next low might occur.

Conclusion

To sum it all up, the SP500 index is currently in a bullish phase. However, we expect the 20-week cycle low to form soon.

After this low is established, we can anticipate a rally toward the peak of the 18-month cycle. Then the market will start a correction on his way to the 18 month cycle low.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.