The Bitcoins short-term outlook.

This update is the second segment of our Bitcoin market analysis, focusing on the short-term outlook.

For insights into the long-term perspective, please refer to our previous article on Bitcoin’s long-term perspective.

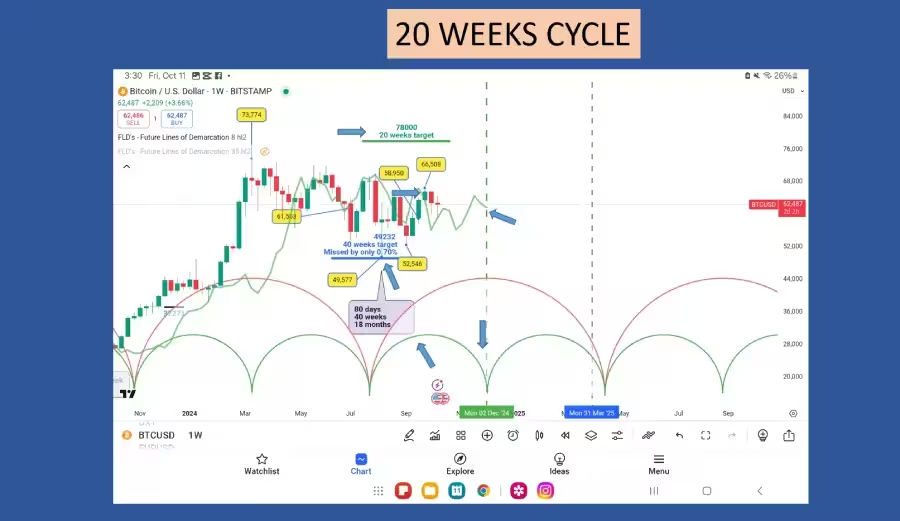

Let’s begin with the 20-Day Cycle.

After completing the last 40-Day Cycle on September 6.

It’s important to note that in the Hurst nominal model, two 20-Day Cycles comprise one 40-Day Cycle, with a 2:1 ratio connecting each cycle up to the 18-month mark.

The Bitcoin market crossed above its 20-Day Cycle line (indicated by blue arrows) at $57,766, providing an upside target of $62,986, which represents a potential profit of $5,220 or 9%.

The market reached this target on September 19, hitting a high of $63,882, with a peak on September 23 at $64,730, followed by a low the next day at $62,720.

This sequence yielded profits exceeding $5,000.

After Bitcoin confirmed its 20-Day low on September 24, I drew the 20-Day Cycle trend line from the September 6 low to the September 24 low. A break below this trend line will help us identify the next 20, 40, and 80-Day Cycle peaks.

On September 30, the market fell below this trend line, confirming the formation of 20, 40, and 80-Day Peaks.

The following day, October 1, Bitcoins sharply crossed below its Cycle line, confirming the peaks at $66,508 on September 27.

The cycle line’s crossing point occurred at $63,329, indicating a downside target of $60,150, offering a potential profit of $3,179 or 5%.

The current 20-Day Cycle low is anticipated to form on October 12. However, following a sharp rally on October 11, there’s a high likelihood that the October 10 low will serve as the 20-Day low.

Confirmation of this low will occur when the market crosses above its Cycle line. For a valid signal, the mid-point of the day must cross the cycle line, not just the top of the bar or candle.

According to J.M. Hurst’s principle of synchronicity, this will also apply to the 40 and 80-Day lows.

If October 10 is confirmed as the 20-Day low, the next low is expected on October 29, represented by the green sine wave at the bottom of the chart.

The success rate for the 20-Day Cycle stands at 77%, meaning if one trades all 20-Day signals from the beginning of the year, there’s a 77% success rate.

With the 20-Day Cycle forming a low on October 10, the Cycle Trend is currently upward.

If this holds true, the upward movement should persist until the cycle reaches its next peak.

As this will be the first 20-Day Cycle peak of the new 80-Day Cycle, the short-term trend is expected to be bullish.

We can anticipate Bitcoin to hit its peak during the right part of the cycle.

The cycle’s peak is projected for October 19, making it reasonable to expect Bitcoin’s price peak for this 20-Day Cycle to occur between October 20 and 22.

Following this peak, Bitcoin should enter a correction phase to seek support on its cycle line before resuming its upward momentum toward the second 20-Day Cycle peak.

If the peak occur before the October 19, this will be bearish and we can start to considerate a bearish scenario.

The 40-Day Cycle: An In-Depth Analysis

Since the significant low observed on August 5, we have entered the second 40-day cycle.

Typically, the second cycle of the next larger degree tends to be less bullish or, in the case of a bearish market, more bearish than the initial cycle.

Currently, the low for this particular 40-day cycle is anticipated on October 11.

The blue sine wave depicted at the bottom of the chart illustrates the 40-day cycle, while the blue line represents the cycle line, also known as the FLD (Frequency Line of Direction).

On September 17, the Bitcoin market crossed above its cycle line at approximately $8,950, as indicated by the blue arrows on the chart.

This movement provided an upside target of $65,354, translating to a potential profit of $6,404 or 10.86%.

Remarkably, just nine days later, on September 26, Bitcoin reached this target, achieving a high of $66,508 on September 27.

By trading based on this signal, investors could have realized a profit exceeding $6,000 in a just nine-day span.

As anticipated for the second 40-day cycle, on October 7, the market fell below its cycle line, recorded at $62,500.

This crossover provided a downside target of $58,492, equating to a potential profit of $4,008 or 6.41%.

On October 10, the market registered a low at $58,867, landing just 0.64% above the target.

Given that this low is within a 1% margin of error, we can confidently consider the target to have been met.

Since the 40-day cycle established its peak on the right side of the cycle (as indicated by the blue dashed line), we can expect a moderate correction in the market.

If the October 10 low is indeed the low for this 40-day cycle, we anticipate the next low to occur on November 13, as illustrated by the blue sine wave.

Confirmation that this 40-day cycle has concluded will occur when the Bitcoin market crosses above its cycle line once again.

What Lies Ahead for Bitcoin?

The Bitcoin market is expected to cross back above its cycle line, setting a new upside target for the next 40-day cycle peak.

There is a strong probability that this peak will manifest on the left side of the cycle.

In this scenario, there exists a possibility that Bitcoin may not reach its next target, with the anticipated cycle peak expected around October 27.

Determining where the next 40-day cycle peak will occur is crucial information for understanding the mid-term trend.

As we embark on a new 40-day cycle this week, the prevailing trend is upward, and historical data indicates a success rate of 80%.

Understanding the 80-Day Cycle in Bitcoin Trading

We anticipated the significant 80-day cycle to materialize following the major low recorded on August 5.

Our projections indicated that this cycle’s low would likely form very soon, specifically on October 12, which falls on a Monday.

In the accompanying chart, the purple sine wave at the bottom represents the critical 80-day cycle.

From a technical standpoint, since this marks the first 80-day low following the significant August 5 low, it is essential for Bitcoin to maintain a bullish scenario.

For this to happen, the market must establish support along this cycle line and avoid crossing below it.

The purple line depicted in the chart signifies the 80-day cycle line, known in J.M. Hurst’s analysis as the Future Line of Demarcation (FLD). This powerful analytical tool provides insights into market trends and potential reversals.

For more in-depth information on the FLD and its application within Hurst’s framework, I highly recommend reading the article I published few weeks ago.

As we look to the time when Bitcoin is expected to form its 80-day low, the FLD will be positioned at approximately $54,285, which is considerably low.

If the market establishes its low well above this cycle line, it will be interpreted as a bullish indicator.

However, time is of the essence, and there is a high probability that the low will materialize well above the cycle line.

Should we experience a sharp decline over the weekend or on Monday, causing Bitcoin to dip below its cycle line, this would indicate a bearish trend.

On September 18, Bitcoin crossed above its cycle line at $60,000, presenting a potential upside target of $67,454.

Just nine days later, the market reached a high of $66,508, falling short of the target by $946, or approximately 1.40%.

Until the market dips back below its cycle line, this target remains valid.

It is crucial to note that if the market crosses below its cycle line prior to reaching the $67,454 target, this would invalidate the target altogether. Once the 80-day cycle low is confirmed, I will proceed to draw the 80-day cycle trend line, also known as the Valid Trend Line (VTL).

A crossing below this cycle trend line will confirm that the next 80-day and 20-week cycle peak has either already formed or is in the process of forming.

Following the rally on Friday, October 11, the probability is significantly high that the low established on October 10 is indeed the 80-day low we’ve been anticipating.

After the formation of the next 80-day cycle peak, it’s projected that the Bitcoin market will cross below its cycle line, setting a potential downside target as it progresses toward the 20-week cycle low.

The ideal timeframe for the upcoming 80-day cycle peak is projected to be between November 13 and 18.

However, considering this is the second 80-day cycle since the major low on August 5, I expect the peak of this cycle to occur before November 13, likely in the earlier part of the cycle.

The optimal timeframe for both the next 80-day and the 20-week low is anticipated to be within the first two weeks of December.

Given that Bitcoin is expected to reach a low on Monday, the cycle trend should be upward for the subsequent weeks, featuring a success rate of approximately 75%.

The 20-Week Cycle: Insights and Predictions

The current 20-Week Cycle officially commenced on August 5, paralleling the previous 18-Month and 40-Week Cycles.

I anticipate the next significant low to materialize in the first week of December.

Since reaching its major low on August 5, the Bitcoin market has not exhibited strong bullish behavior.

In this context, there is a possibility that the next peak of the 20-Week Cycle might occur earlier in the cycle, known as a “left-time translation” phenomenon.

Typically, following an 18-Month Cycle low, one would expect the market to exhibit a more bullish trend than what is currently observed.

The low for this 20-Week Cycle is projected to find robust support along its cycle line, which should hover around $61,000 in the first week of December.

Notably, during the third week of September, the Bitcoin market crossed above its cycle line (illustrated as the green line on the chart) at $63,800, presenting an upside potential target of $78,000.

Achieving the $78,000 target would not only signify a major milestone for Bitcoin but would also indicate a crossover above the 40-Week Cycle line, paving the way for a bullish trend.

For further insights, refer to my recent long-term perspective article on Bitcoin published last week.

However, it’s crucial to note that if Bitcoin drops below its 20-Week Cycle line before reaching the $78,000 target, this target would become invalidated.

Such a scenario would significantly increase the likelihood of a bearish trend, driven by the downward pressure from longer-term cycles.

Conclusion

Bitcoin is currently at a critical crossroads. As it stands, there are no definitive signs indicating a shift into a bear market. However, it’s essential to stay vigilant and prepared for any sudden changes in market sentiment. The next 80 days and the upcoming 20-week cycle will be pivotal in determining where support will be found.

While the ambitious target of $78,000 may not be achieved during the forthcoming rally due to the pressures from the longer cycles, this doesn’t overshadow the opportunities available for trading within the shorter cycles. Traders can still capitalize on fluctuations and navigate the market effectively in the meantime.